Why Investors Keep Buying Social Media Stocks, Even If They're Overvalued

NEW YORK (TheStreet) -- It's no secret that social media stocks are overvalued now, especially if you look at the fundamentals. Yet investors keep buying them, pushing their prices up even further. The question is why?

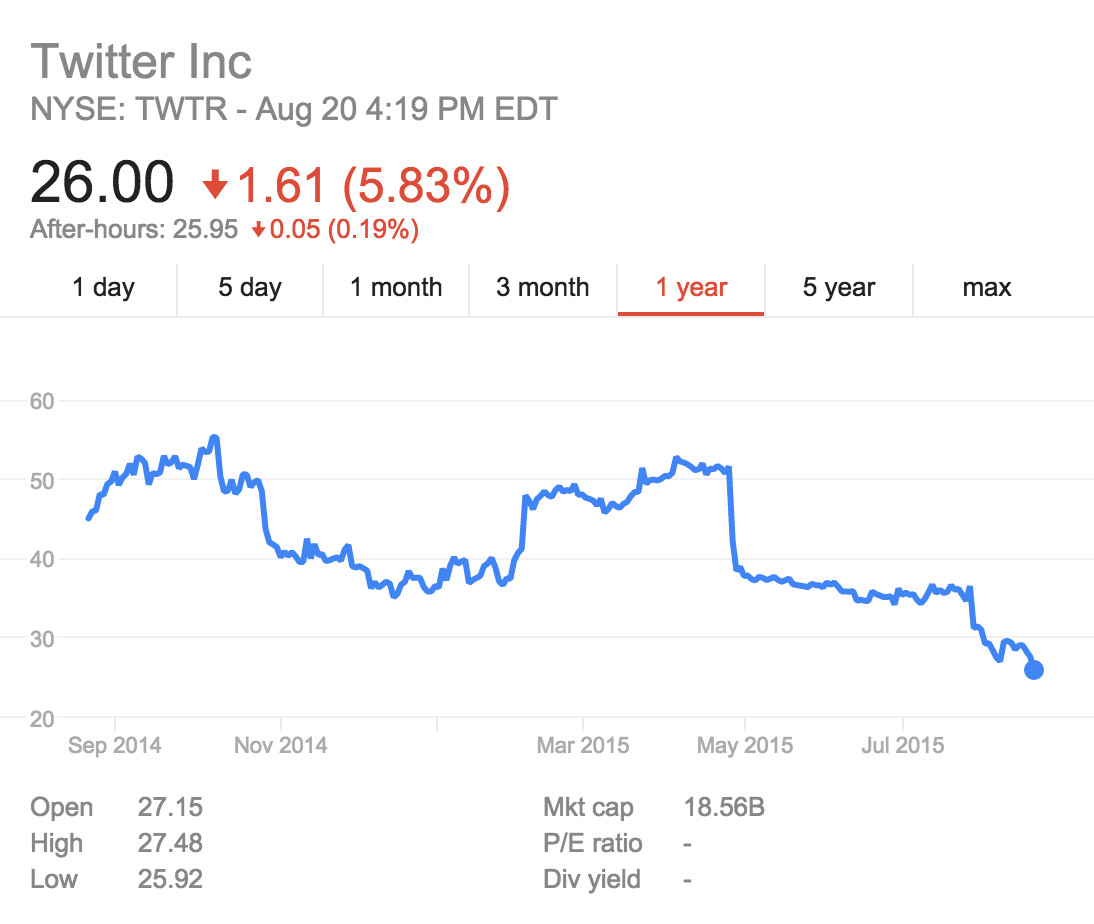

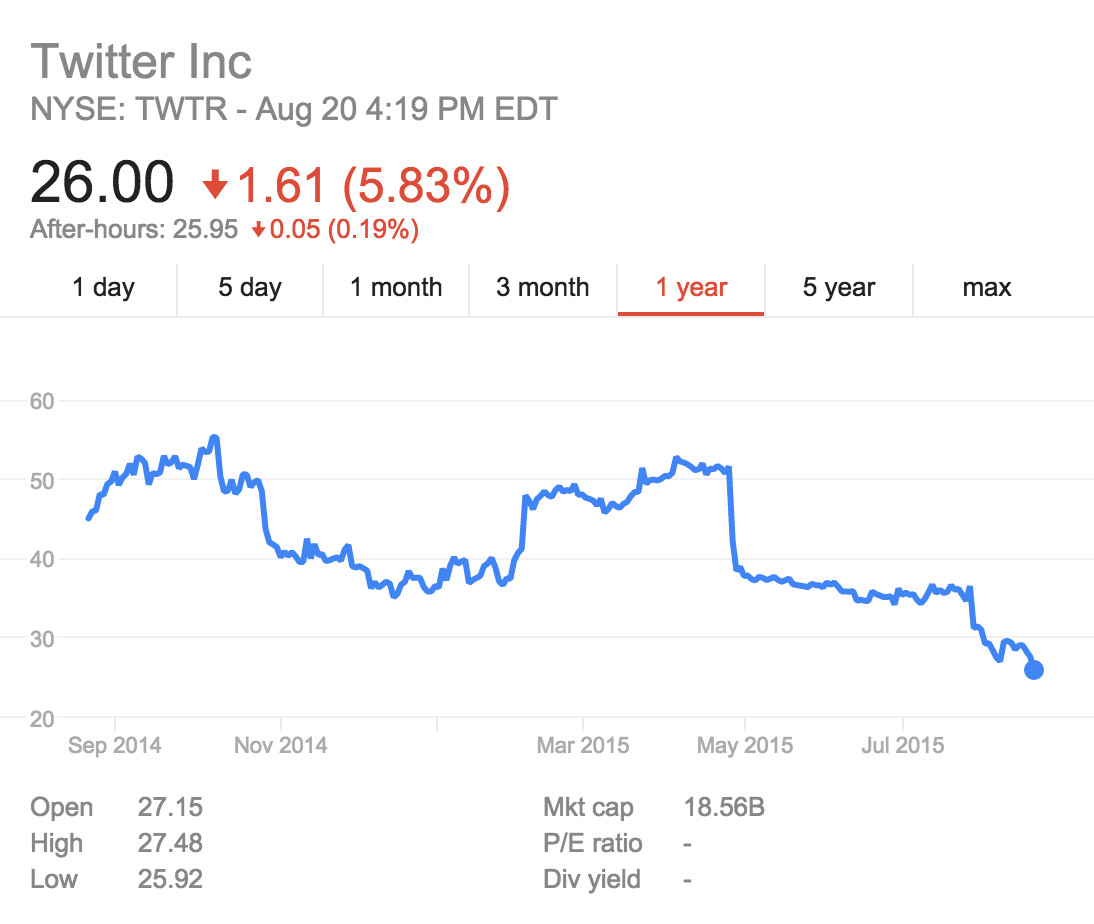

(TWTR - Get Report)

Jim Cramer's charitable trust Action Alerts PLUS owns Twitter. Read AAP's analysis of Twitter's earnings here.

Instagram, just a social-media app for sharing prettied-up photos, was apparently valued at $33 billion by Cowen Group this month, and at $35 billion by Citigroup in December. Even at the lower level, that would put its valuation at 47 times projected revenue for 2015 -- never mind its earnings multiple. Snapchat is an even more excessive example: It's reportedly seeking to sell a $500 million stake that would give it a valuation of between $16 billion and $19 billion -- up from the already huge $10 billion valuation implied by its last funding round in December. Here's the kicker: Snapchat only began to generate revenues ... last month.

When To Short A Stock

Most investors by nature will "go long" when they buy stocks. Few investors naturally will short stocks (or bet on their decline) because they really don't know what to look for. Some investors see the shorting process as somewhat counter-intuitive to the traditional investing process, since many stocks do appreciate over time. That said, there is a lot of money to be made by shorting, and in this article, we'll give you a list of signs that show when a stock might be ripe for a fall.

Technical Trends

Look at a chart of the stock you are thinking about shorting. What is the general trend? Is the stock under accumulation or distribution?

Social Media 1.0 Is Dying. Long Live Social Media 2.0

Yelp has publicly admitted it is in trouble. Twitter is currently hunting for a new CEO and there are constant rumors they will be acquired. Is social media dead? The simple answer is no, social media will continue to live on. What the industry is seeing is the sun setting on Social Media 1.0 and the dawn of Social Media 2.0.

When individuals look back on the dawn of social media that was trailblazed by Yelp and Twitter, there is no question that they will be remembered as the founders of social media. These companies created the vocabulary and the need. Everything from "tweets" to "selfies" the vocabulary that society knows today can be attributed to these social media founders. The question which arises today is what do these social media founders do as the industry they helped to create grows beyond them.

This trend is not unprecedented. If one looks back to the growth of the search engine industry, the same patterns emerged. During the booming heyday of search engines, the Internet was littered with numerous competing search engines. From Yahoo! to Webcrawler and Ask Jeeves, everyone was starting up a search engine to capitalize on the growth of the Internet.

“Two billion of you create social content and get nothing for it. It’s your content, your audience and you should own it.”

So proclaims a new upstart called tsū that says it will pay users part of the advertisement revenue that they generate for the network when they share and post content (ignore the sloppy English):

On tsū, users own their content and own their network, therefore they own the royalties generated from advertising, sponsorship and partnership dollars wrapped around their content. Additionally if any users came to the platform via a user’s short code or invitation, then that user will in perpetuity earn a portion of the economics of the newly invited individual and their social network on tsū.

This only happens on tsū and mechanically cannot happen on any other incumbent platform. If a tsū user’s post is viewed, that post creates economics – at the very least an advertisement is served alongside that post which is revenue. tsū simply arranges these revenues to trickle to the users as royalties via our algorithm that rewards both relevant content and social network building.

3 Reasons the Social Media Fad is Already Dying

Facebook is growing, but only in developing markets. In the US, Facebook lost 6 million users in just one month. It lost 9 million in the past half year, and an additional 2 million in the UK over the same time period. This isn’t new, either. About this time last year, studies started reporting a declining interest in Facebook among teens and young adults as they started spending less time on the site.

Sean Parker 'Bored' By Facebook -- And It Seems He's Not The Only One

So what does Sean Parker really think about Facebook, the company that netted him some $2 billion following its recent public offering?

It’s a snooze.

That’s what Parker told an audience ofjournalists, celebrities and well-wishers at the launch of his new Facebook-powered video-chatting service Airtime earlier this

Conclusions

In this paper we have applied a modified epidemiological model to describe the adoption and abandonment dynamics of user activity of online social networks. Using publicly available Google data for search query Myspace as a case study, we showed that the traditional SIR model for modeling disease dynamics provides a poor description of the data.

A 75% decrease in SSE is achieved by modifying the traditional SIR model to incorporate infectious recovery dynamics, which is a better description of OSN dynamics. Having validated the irSIR model of OSN dynamics on Google data for search query Myspace, we then applied the model to the Google data for search query Facebook. Extrapolating the best fit model into the future suggests that:

Facebook will undergo a rapid decline in the coming years, losing 80% of its peak user base between 2015 and 2017.

The most significant change in equity funds management over the past decade has been the emergence of short funds, which seek to profit from falling stocks.

The buy and hold strategy of the more traditional long-only fund managers only goes well when the market goes well.

But managers that can take short positions in stocks can take bets on shares they think will fall, and profit when they do, open up a whole new revenue stream.

And they're good at it. The huge slump in the price of Metcash and Flight Centre after recent profit downgrades has delivered instant profits.

In the past some investors would follow changes in substantial holdings and directors' interests as a guide to what stocks are hot or out of favour. Now it's a list of which stocks are sold short the most.

According to Morgan Stanley, the top 10 short positions right now, as a percentage of their market cap in the major S&P ASX 200 index, are Flight Centre, Fortescue Metals, Myer, Metcash, Mineral Resources, WorleyParsons, Monadelphous, Orica, Senex Energy and Whitehaven Coal.

Lessons From a Short Seller

Ask any student of the stockmarket what they deem to be the ‘biggest disasters’ in corporate history and most people will settle for Enron, WorldCom, HIH and A.B.C. Learning Centres. These multibillion-dollar corporations at least appeared to go bankrupt overnight, taking with them billions from the portfolios of some of the world’s smartest investors.

Many dismissed these spectacular failures as ‘black-swan-type’ events—completely unforeseeable. Not Jim Chanos, founder of Kynikos Associates. He not only predicted their demise, he profited from them. Just as he did when he ‘shorted’ Macquarie Bank in 2007 (see Steve Johnson’s Bristlemouth blog post, Chanos was right, I was wrong).

Chanos started Kynikos (Greek for ‘cynic’) funds to profit from a practice known as ‘short-selling’ (see our Investor’s College article on the subject, Short selling, short change). The mechanics of short selling seem technical but the main thing to remember is that short-sellers profit when stock prices of companies go down.

A Passing Thought...