Faltering Oil Rally Boosts Leveraged Loan Defaults, Fitch Says

Templar, Stallion likely to miss interest payments, Fitch says The defaults would push energy default rate to nearly 18% The default rate for leveraged loans in the energy sector could spike close to 18 percent if Templar Energy LLC and Stallion Oilfield Services Ltd. are unable to make interest payments on their debt, Fitch Ratings said. The companies will likely be forced to default on the loans in August, according to Fitch, as weak oil and gas markets leave them short on cash. The July trailing 12-month energy leveraged loan default rate rose to nearly 14 percent from 11.3 percent in June, Fitch said. Officials at Templar, an oil and gas exploration company, and Stallion, which provides drilling support, didn’t immediately respond to requests for comment. “The impact of commodity price pressures has been the largest driver of defaults in the leveraged loan market this year,” said Eric Rosenthal, […]

Thanks to Japan’s radical Abenomics stimulus efforts, Japan’s central bank buys up most of the government-issued debt anyway. In 2013, the central bank owned less than 15% of Japan’s government bonds. Today, it’s more than 30% … and rising.

And with interest rates (and bond yields) in negative territory, who in their right mind (besides those deluded central bankers) would want to buy Japanese government debt anyway? For financial institutions like Bank of Tokyo-Mitsubishi, why bother with staffing a bond desk to begin with?

Treasuries have a higher risk premium than cash because they’re subject to duration and inflation risks. This higher risk premium is what compels investors to exchange dollars for treasuries. The same goes for corporate debt, high-yield, real estate, and equities. The larger the spread between assets, the more investors are compensated for assuming greater risk (ie, selling bonds to buy equities).

The industrial robots might also solve a growing problem: China's dwindling supply of cheap, low-skilled labour. For three decades, that was the magic ingredient that pushed this economy to become the second biggest in the world. Millions of labourers left the countryside and flooded the industrial cities, lifting themselves out of poverty and their children into the middle class.

But now, there aren't enough of those children. The population is aging. The so-called demographic dividend is fading.

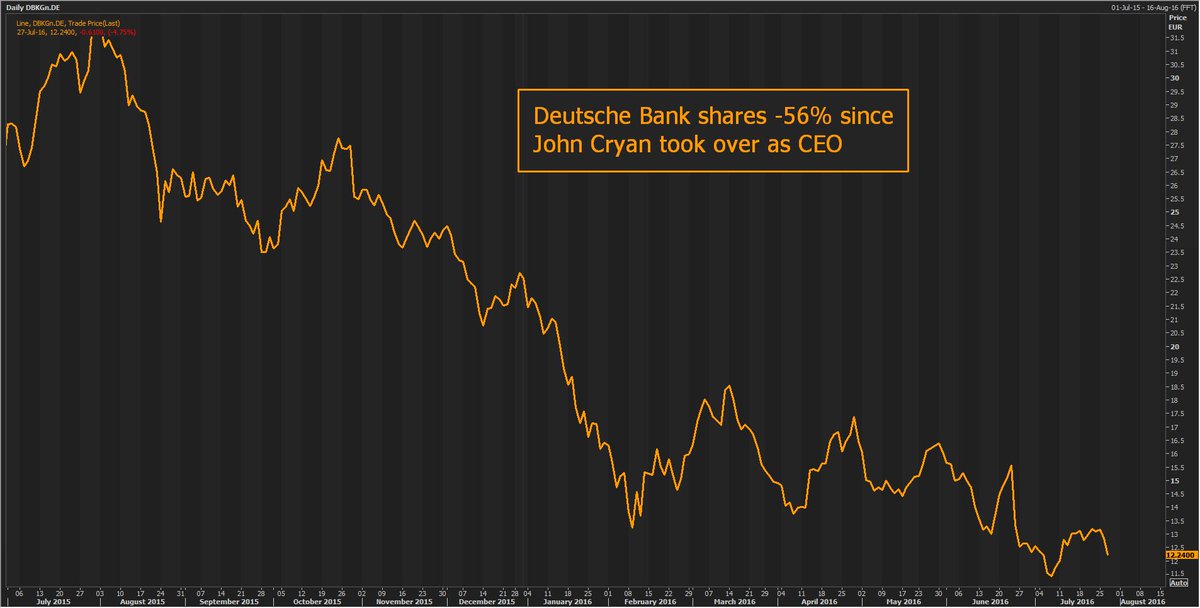

Deutsche Bank profits plummet 98%, CEO warns of further cuts

Germany’s biggest bank posted a net profit of €20 million in the second quarter of the year. This is down from €796 million in the same period in 2015.

Deutsche's share price fell by four percent on Wednesday after the announcement. Analysts’ predictions had varied from more than a billion euro loss to half a billion profit.

Deutsche Bank chief executive John Cryan warned about the possibility of further cuts.

"If the current weak economic environment persists, we will need to be yet more ambitious in the timing and intensity of our restructuring," he said on Wednesday.

Overall, Deutsche Bank’s shares have lost about 44 percent of their market value in 2016. This is partly due to increasing skepticism about the bank’s position in the market and $14 billion in fines.

Revenue is down 20 percent in the three months, partly because of the Brexit vote. The investment bank slid 28 percent. At the same time, revenue from Deutsche’s foreign exchange business was flat, even though there was increased client demand for currencies in the wake of the British decision to leave the EU.

Revenue is down 20 percent in the three months, partly because of the Brexit vote. The investment bank slid 28 percent. At the same time, revenue from Deutsche’s foreign exchange business was flat, even though there was increased client demand for currencies in the wake of the British decision to leave the EU.