Advisers Stop Investors From Acting On Political Anxiety

The last two weeks of definitive primaries have not only been a game-changer for the 2016 U.S. Presidential race, but they also have been a bellwether for some investors.

Last week, Robert Wander, a financial adviser with his own firm in New York, got his first email from a client for this election cycle worrying about the impact on the stock market. The client wants to move all his assets into cash before votes are cast in November.

"I don't know his political leanings. For most clients, it's not something I get into, unless they are also friends of mine. There's no advantage in that," Wander said.

Mr. Koskinen was not even in government when the I.R.S. admitted to singling out the tax-exemption applications of Tea Party groups for scrutiny. Organizations on the I.R.S.’s “lookout lists” went beyond conservative groups to include groups like Palestinian rights activists and open-software developers, but the scrutiny of hundreds of Tea Party applicants infuriated congressional Republicans.

The official answer is to limit money-laundering by drug traffickers and criminals. But laundering money through official banking channels is not that difficult, so cash is not necessary for laundering.

Another official reason is tax evasion. But tax evasion is now so easy, once again cash is not required: The World’s Favorite New Tax Haven Is the United States: Moving money out of the usual offshore secrecy havens and into the U.S. is a brisk new business.

In the aftermath of the Stock Market Crash of October 1929, financial panic gripped the United States of America. The Great Depression (1929-1941) was the longest-lasting sustained economic downturn in the history of the Western industrialized world.

The Fed Setting Up For A U.S. Dollar Collapse If No June Rate Hike

Summary

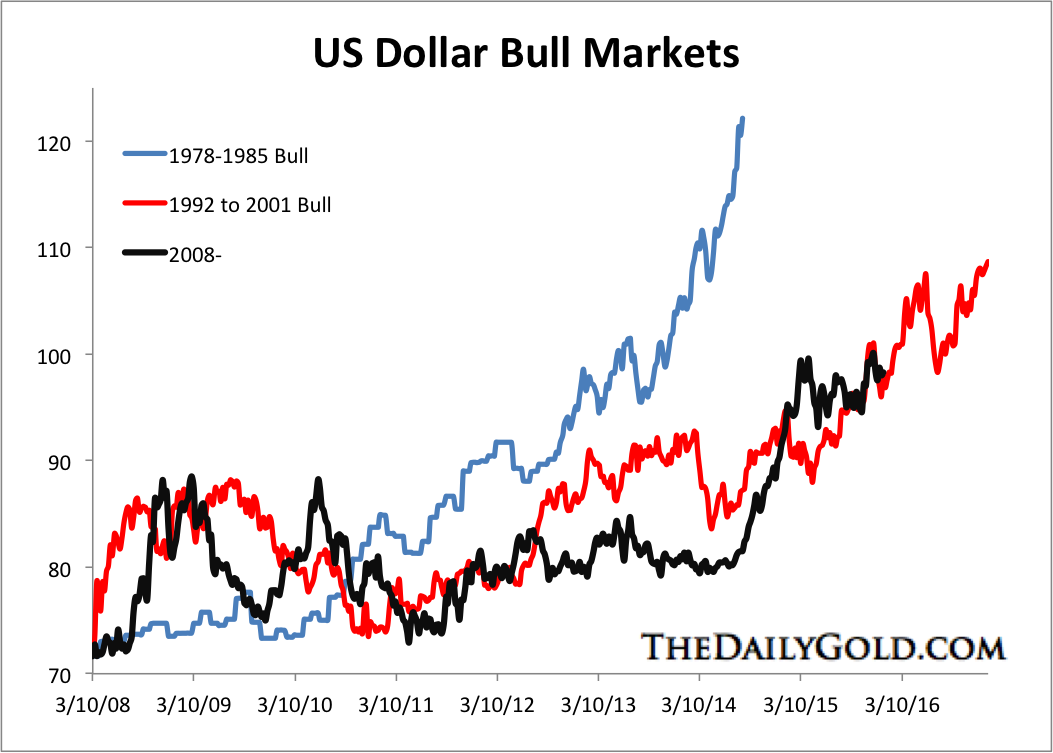

The U.S. dollar index has been on the rise thanks to Fed officials talking up rate hikes.

Propping up the U.S. dollar by the Fed is referred to as a “Fed Dollar Put”.

The Fed may have already painted themselves into a corner about rate hikes.

A no June rate hike decision may cause a dollar collapse as speculators pile onto short positions.

The U.S. dollar index, or DXY, a weighted index of the value of the U.S. dollar relative to a basket of six major currencies, has bounced 3.72% since its 15-month low on May 3, when Atlanta Fed President Dennis Lockhart and his San Francisco Fed colleague John Williams told reporters that U.S. financial markets may be underestimating the odds of a central bank rate increase at the June 14-15 Federal Open Market Committee, or FOMC, meeting.

The U.S. dollar index, or DXY, a weighted index of the value of the U.S. dollar relative to a basket of six major currencies, has bounced 3.72% since its 15-month low on May 3, when Atlanta Fed President Dennis Lockhart and his San Francisco Fed colleague John Williams told reporters that U.S. financial markets may be underestimating the odds of a central bank rate increase at the June 14-15 Federal Open Market Committee, or FOMC, meeting.