America’s biggest banks aren't ready for next meltdown

|

When Audited Leverage And Risks Are Hidden IN GAAP

WASHINGTON— The main financial risk facing the United States today looks very similar to what caused so much trouble in 2007-2008: big banks with too much debt and too little equity capital on their balance sheets. Uneven global regulations, not to mention regulators who fall asleep at the wheel, compound this structural vulnerability.

We already saw this movie (see below), and it ended badly. Next time could be an even worse horror show.

All booms are different, but every major financial crisis has at its heart the same issue: major banks get into trouble and teeter on the brink of collapse. Disruption at the core of any banking system leads to tight credit, with major negative effects on the real economy. In our modern world, in which finance is interwoven throughout the economy, the consequences can be particularly severe — as we saw in 2008 and 2009. Read More.

REMEMBER 2005!

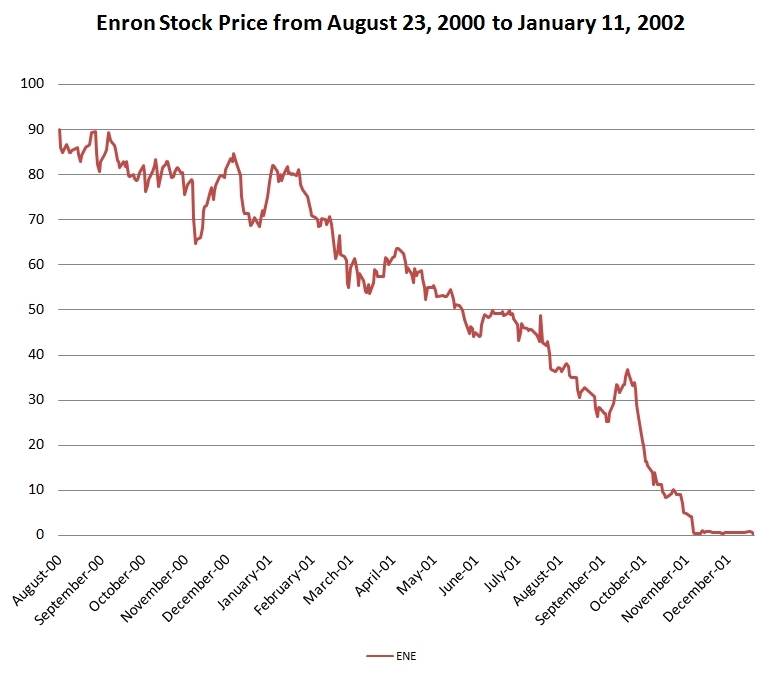

Famous Accounting Frauds - Evaporating Wealth In Virtual Moments

Platinum Wealth Partners - Top Investors Edge

Lets face it, since inception the purpose of Banks was to create liquidity in the economy through leverage of its own balance sheet. The premise for this excessive leverage was the collateral they held on the credits provided to others. But the sensibilities of this premise falls apart when credits are unsecured and leverage ratios climb to new heights by paying corrupt audit firms to create costume accounting practises. In the simple vernacular - lies.

Today, as a result, the leverage in the system could be as low as 35:1 or beyond 200:1. The point being, nobody truly knows - and consequently, the street's sense is that the financial mathematics is now so shaky that even a slight upward rise in rates will wipe out a substantive portion of the Banks' asset and equity values - leading to a complete systemic collapse. Enron's chart above for instance is a foreshadowing test case for the whole system that we now have in place. Not a pretty picture.

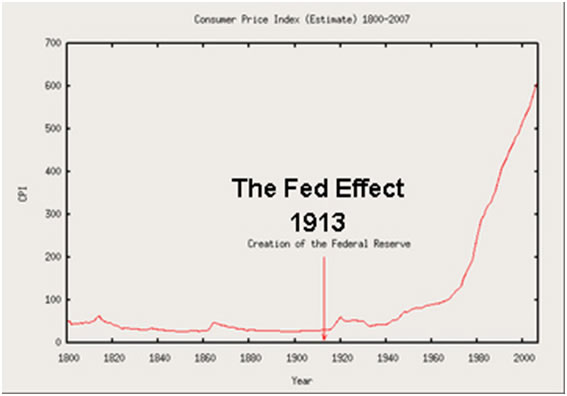

That's why everyone is so worried. That's why CPI needs to be manipulated. That's why the US dollar could lose its reserve currency status. That's why no one dare raise rates by the slightest percentage.

That's why one day all the corruption, markets and economies are mathematically boxed into an algebra articulating the certainty of "The Mother Of All Crashes",

" One day!"

International Offices

April 30, 2015