Stories Going Beyond The Mainstream

"Teacher Seeks Pupil"- Ishmael

Without Gorilla Will There be Hope For ...?

Earth's Future At Risk As Great Apes Face Extinction

http://www.ishmael.org/origins/ishmael/

Four out of six great apes one step away from extinction – IUCN Red List

Today’s IUCN Red List update also reports the decline of the Plains Zebra due to illegal hunting, and the growing extinction threat to Hawaiian plants posed by invasive species. Thirty eight of the 415 endemic Hawaiian plant species assessed for this update are listed as Extinct and four other species have been listed as Extinct in the Wild, meaning they only occur in cultivation.

The IUCN Red List now includes 82,954 species of which 23,928 are threatened with extinction.

Mammals threatened by illegal hunting

The Eastern Gorilla (Gorilla beringei) – which is made up of two subspecies - has moved from Endangered to Critically Endangered due to a devastating population decline of more than 70% in 20 years. Its population is now estimated to be fewer than 5,000. Grauer’s Gorilla (G. b. graueri), one subspecies of Eastern Gorilla – has lost 77% of its population since 1994, declining from 16,900 individuals to just 3,800 in 2015.

Realty Check: The Whole Economic System Is On Welfare

Central Banks = Welfare for the Wealthy

Central banks can only do one thing, and that's provide monetary welfare for the wealthy.

The fact that central banks provide welfare for the wealthy is now entering the mainstream. The fact that all central bank policies since 2008 have dramatically increased wealth and income inequality is now grudgingly being accepted as reality by mainstream economists and the financial media.

The central banks' PR facade of noble omniscience on behalf of the great unwashed masses has cracked wide open. Even The Wall Street Journal is publishing critiques of Federal Reserve policies that suggest the Fed has no idea how the U.S. economy actually works because their policies have failed to help the bottom 95%.

Suncor Unloading Oil-Sands Assets

Suncor Energy Seeks Permission to Abandon Some Oil-Sands Assets

Suncor Energy Inc., SU -0.58 % Canada’s largest oil producer, is in talks with government officials for permission to “strand,” or abandon, some high cost and greenhouse gas-intensive crude-oil deposits, the company’s chief executive said Wednesday. The Calgary-based company is seeking an easing of rules designed to maximize oil-sands production from leases on government land, CEO Steve Williams said at a Barclays BCS -0.66 % energy conference in New York, reiterating a strategy he first announced in July. “We’ve begun to have conversations with the government of Alberta and the current regulators about the design of their policy, which actually requires the maximum amount of resource to be extracted regardless of the economic or environmental value,” he said. The request comes as Suncor and other oil producers struggle to cut costs...

The Wall St Lambs: Wells Fargo Terminates 5,300 Rank & File Banksters

What About These Guys?

"The Oversight Dream Team"

Major Problems Announced At One Of The Largest Too Big To Fail Banks In The United States

Wells Fargo Bank, one of the nation's largest banks, has been hit with $185 million in civil penalties for secretly opening millions of unauthorized deposit and credit card accounts that harmed customers, federal and state officials said Thursday.

Read More

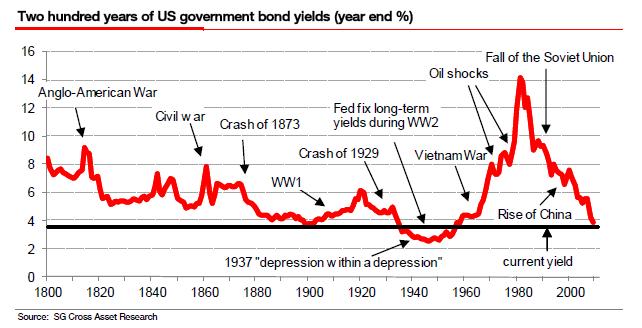

Top Global Bonds Manager Positioning For Higher Rates

Unusual move sees manager Richard Woolnough protect £15 billion M&G Optimal Income fund from high bond prices and rising inflation.

Woolnough moves to 'negative duration' on UK bonds

The country’s leading bond manager, Richard Woolnough, has moved to ‘negative duration’ on UK debt for the first time in response to the rising threat of inflation and the surge in bond prices since the EU referendum.

Expressed in years, duration is the measure used to show a bond fund’s sensitivity to interest rate changes.

The current overall duration for Woolnough's 15 Billion M&G Optimal Income fund is currently at a low 2.6 years, reflecting the view that interest rates in the developed world are expected to slowly rise following the first increase in US rates at the end of last year.

Rigged Stock Markets Won't Signal Economic Collapse

These are the signs of an economic collapse

What does the beginning of an economic collapse look like?

Do you see grocery stores closing? Do you see other retailers, like clothing stores and department stores, going out of business?

Are there shuttered storefronts along your Main Street shopping district, where you bought a tool from the hardware store or dropped off your dry cleaning or bought fruits and vegetables?

Are you making as much money annually as you did 10 years ago?

Future Grid Electricity Cannot Rely On Intermittent Renewables

Many people are hoping for wind and solar PV to transform grid electricity in a favorable way. Is this really possible? Is it really feasible for intermittent renewables to generate a large share of grid electricity? The answer increasingly looks as if it is, “No, the costs are too great, and the return on investment would be way too low.” We are already encountering major grid problems, even with low penetrations of intermittent renewable electricity: US, 5.4% of 2015 electricity consumption; China, 3.9%; Germany, 19.5%; Australia, 6.6%.

In fact, I have come to the rather astounding conclusion that even if wind turbines and solar PV could be built at zero cost, it would not make sense to continue to add them to the electric grid in the absence of very much better and cheaper electricity storage than we have today. There are too many costs outside building the devices themselves. It is these secondary costs that are problematic. Also, the presence of intermittent electricity disrupts competitive prices, leading to electricity prices that are far too low for other electricity providers, including those providing electricity using nuclear or natural gas. The tiny contribution of wind and solar to grid electricity cannot make up for the loss of more traditional electricity sources due to low prices.